CDI uses a customized computer software called the CDI Recovery System (CRS) for debt collection management. CRS is specifically developed to meet CDI and her clients’ needs in the local debt recovery markets. The CRS is premised on the fact that good debt collection is about effectively keeping track of all debtor details and thus the system captures the following; their addresses, contacts, next of kin, current debt, repayment schedule and plans and timely reminders through diary/calendar system to both the responsible Account manager (s) and debtor(s) (e.g., through prompt mobile telephone SMS).

The CRS has an easy to use interface that has two modules; the Debt Collection Manager and debt collector and also has a secure regular back up database system to store all this information. The Debt Collection Manager (Administrator Module) is responsible for access management (issuance of pass words) and assigning debtors to account managers for follow up and collection.

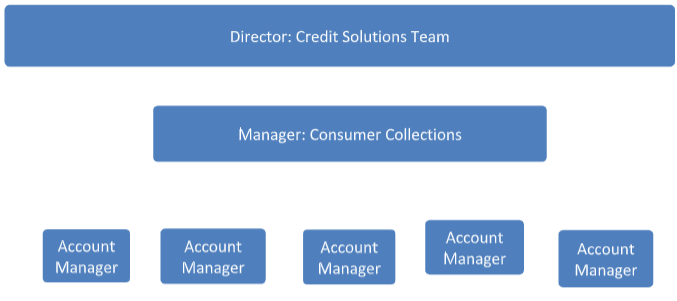

The CRS has an escalation mechanism where problem fixing is shared with immediate supervisors through the CDI management hierarchy. The system permits the generation of management reports and can provide key outputs such as; Promises to Pay (PTP), Kept Promises Ratio (KPTP), Right Party Contacts (RPCs) and Efficiency Ratios (ERs).

The CRS can be configured to make the bank access activity on our platform and be able to generate reports and monitor performance regularly.

Copyright ©2025 Consulting and Development International . All Rights Reserved. Designed : Lwegatech